Brokers, have you recently been issued a Term Sheet during a private lending enquiry? Don’t get too excited just yet.

It is critical to note that a Term Sheet is not a commitment to advance funds. It is simply an invitation to a first date, an expression of interest, provided that your client (the Borrower) is able to meet the terms and conditions outlined in the document.

So, what information should be provided in a Term Sheet?

A comprehensive Term Sheet will detail the following:

- Name of Borrower (s)

- Name of Mortgagor (s)

- Guarantor(s)

- Security Property

- Loan Purpose

- Facility Type

- Facility Term

- Minimum Interest Period

- Loan to Valuation Ratio

- Facility Limit

- Funding Table (Construction Loans)

- Lower Interest Rate

- Higher Interest Rate

- Line Fee

- Commitment Fee

- Lender App Fees

- Brokerage Fee

- Right to Caveat / Charging Clause

- Interest Repayment

- Loan Security

- Conditions Precedent

- Expiry Date

Two contentious clauses

We often see two clauses that require a review:

Commitment Fees

We can’t comment on the practices of other lenders.

With Vado Private, a commitment fee is fully refundable in circumstances where the application for finance is not approved ostensibly on the terms and conditions outlined in this Indicative Term Sheet. The commitment fee is not refundable when the Borrower decides not to proceed.

Vado Private charge commitment fees because:

- We commit the capital (to give borrower certainty on funding).

- We commit time and resources.

- We want a commitment from the borrower (as they do from us).

Right to Caveat

Vado Private do not apply a charging clause in our Term Sheet. This clause gives the Lender the right to lodge a caveat / charge the property offered as security or other properties owned by the borrower and guarantor.

Given the potential implications, these charging clauses should be reviewed carefully. Specific attention should be given to the conditions in which a caveat can be lodged and what can be claimed by the lender.

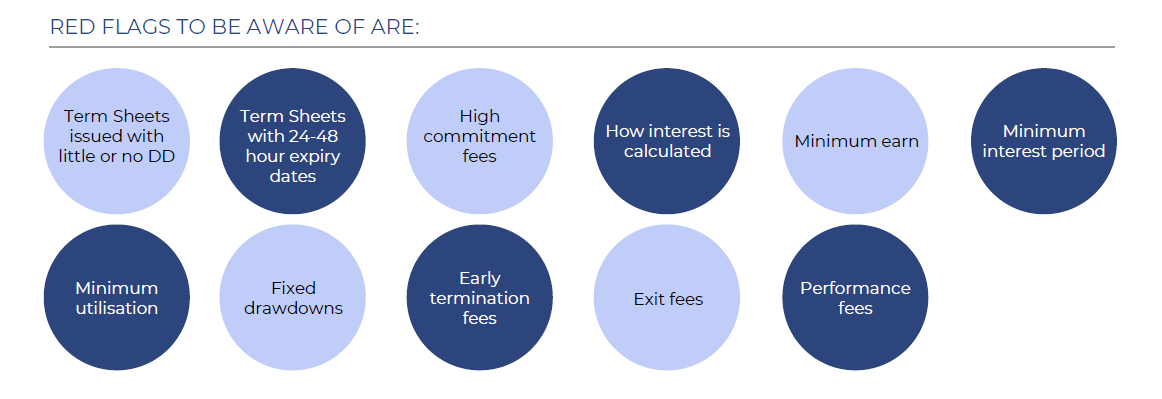

We also note a number of red flags can be presented in the Term Sheet process, we summarise them here:

For assistance

Vado Private provides bespoke financing solutions tailored to the specific needs of borrowers. We would love the opportunity to chat to you regarding any scenarios or questions. Please contact the Business Development team at Vado Private to discuss any opportunities on the details below, or you can submit a scenario online via our website.

Hien Nguyen

0424 983 770

Sanjay Anand

0424 486 788