Residential Dwelling, Drummoyne NSW 2047 Vado Private provided funding for the purchase of a fully detached reside [...]

Construction in Liverpool NSW 2170 Vado Private provided funding for the construction of 12 townhouses in Liverpool [...]

Residential Development Site, Sunbury VIC 3429 Vado Private provided funding for the purchase of a development block [...]

Duplex Construction, Yowie Bay NSW 2228 Vado Private provided funding for the construction of two duplexes in Yowi [...]

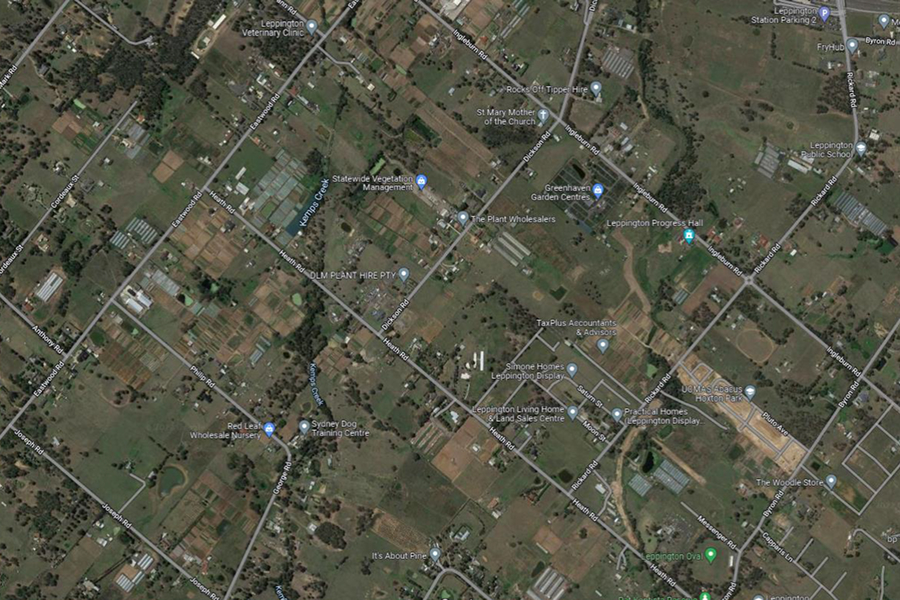

Commercial Development Site, Leppington NSW 2179 Vado Private provided funding for the borrower to acquire two vaca [...]

Residential Apartment Construction, Coogee NSW 2034 Vado Private provided funding for a development site with DA ap [...]