CAPITAL DEPLOYED

OVER $530 MILLION

CAPITAL RETURNED

100%

INVESTOR RETURNS (AVERAGE IRR)

10.09%

WEIGHTED AVERAGE LVR

59%

*Metrics as at 30 April 2025. Investments can go up and down.

Past performance is not necessarily indicative of future performance.

Welcome to Vado Private

Where smart investing meets tailored lending.As an investment manager specialising in real-estate-backed credit investments, we offer attractive returns for investors and flexible financing for borrowers.

With a reputation built on expertise, transparency, and performance, we provide opportunities that go beyond the traditional, helping clients grow their wealth with confidence.

For investors, we prioritise capital preservation and aim to deliver reliable, income-generating opportunities through commercial loans secured by real property assets.For borrowers, we offer tailored, common-sense lending solutions designed to meet the requirement at hand.

Our streamlined approach ensures access to capital when it matters most, without the rigid constraints of banks.

We’re not just another lender; we connect savvy investors with compelling property-backed investment opportunities.

Unlock Smarter Investment Insights

Unlock Smarter Investment Insights

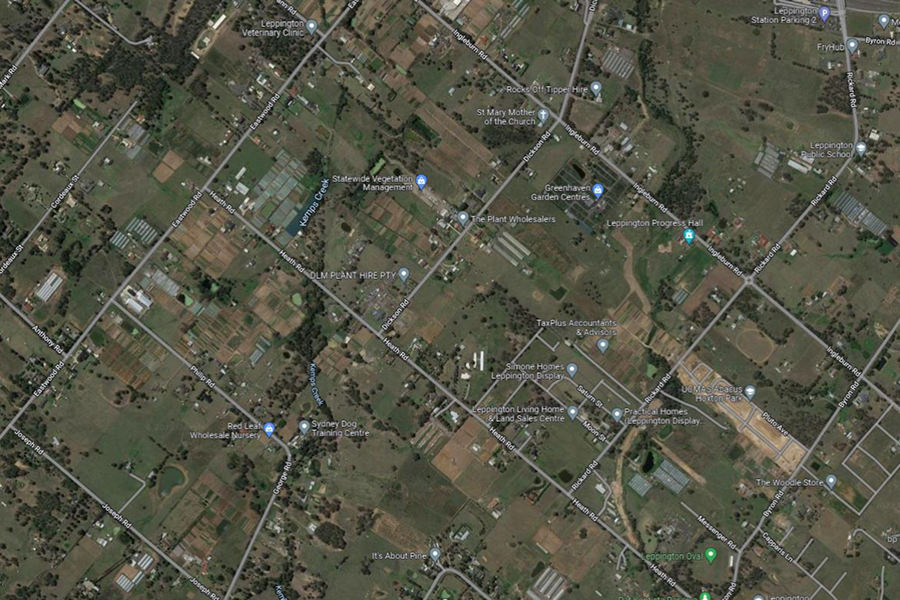

Track Record

Over $530 million in real-estate backed loans & zero investor losses to date.

Vado Private has a proven track record of enabling great projects – and great outcomes.

We help borrowers move quickly with funding that’s flexible and tailored to the deal. And for investors, we unlock access to property-backed opportunities that deliver strong, risk-adjusted returns.

The projects below represent just a few of the successful developments we’ve supported. From acquisition to completion, each one showcases our ability to structure smart capital and back the right people with the right support.

Insights

Smart takes on property, finance and the market.

From funding tips to market trends, our blog breaks it down so investors and borrowers can stay ahead, make confident decisions, and spot the next opportunity.